"Beat to hell" stock with massive upside potential

Crushed by year-end selling, booted from indexes, governance issues, hated. Yet deep value, situational alignment of interests + "call option" upside creates favorable risk/reward

You don’t get deep value - $.10 on the dollar cheap - without a security being deeply hated by Mr. Market.

This is just such as case

The majority of revenue at this business comes from senior housing - a business that was hammered by the Covid crisis, and then sucker punched by an explosion in the cost of finding and hiring workers.

Occupancy plummeted while costs skyrocketed - not a winning formula.

Basic assumptions

If you think it is probable that senior housing will revert to the mean or potentially enter a more favorable period given changing demographics, this idea might interest you.

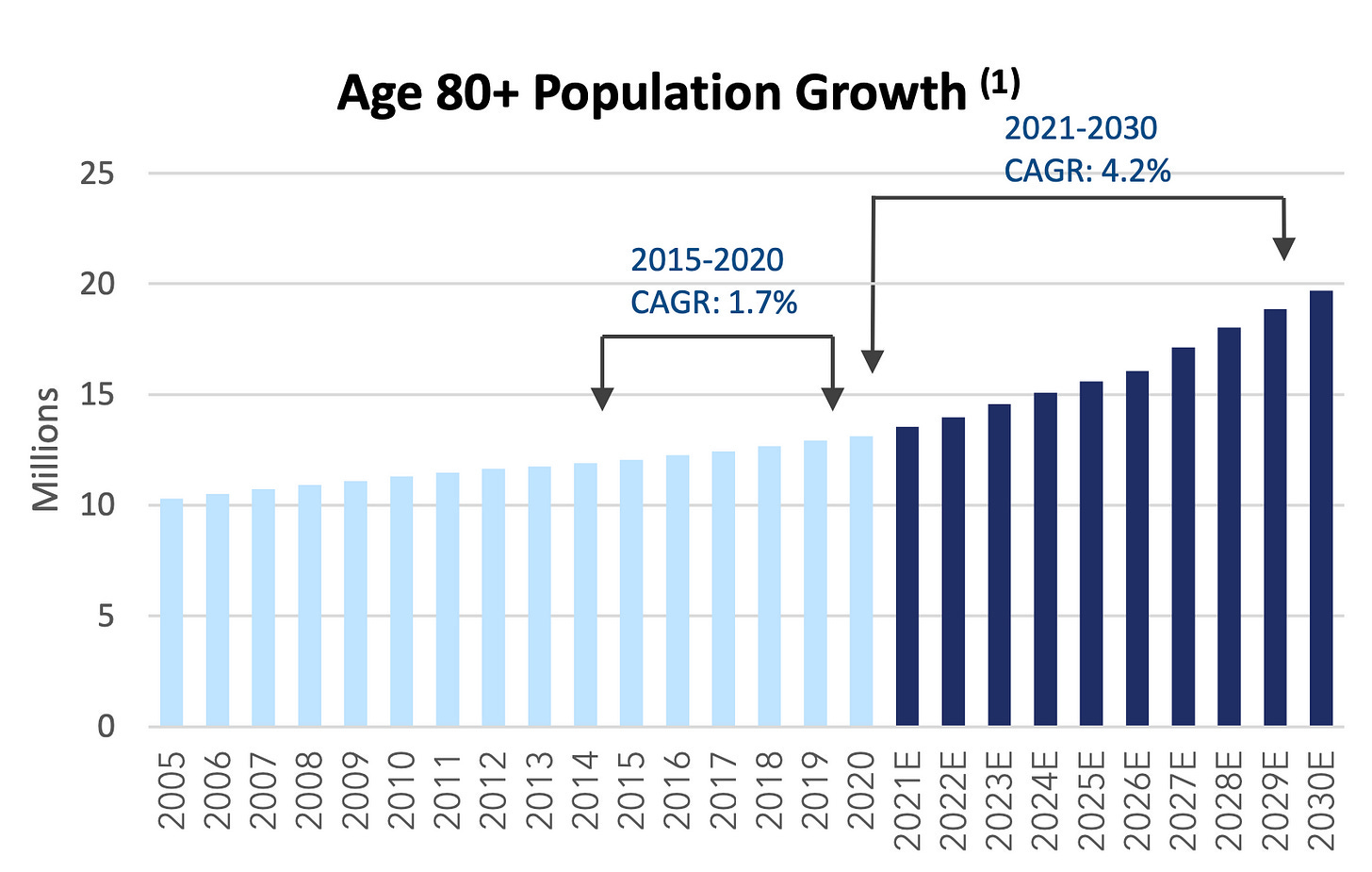

Construction of new Senior housing has plummeted while the number of seniors over 80+ years old is accelerating:

However, I don’t pretend to know the future - the bet here is that this security is deeply underpriced relative to its potential to rebound - which appears to be in progress.

Note: This is a more speculative/leveraged idea, and as such I am using the position sizing approach that I wrote about here.