The market is asleep on Innovative Solutions & Support (ISSC)

I believe that ISSC can double run-rate revenue and triple earnings by the end of fiscal year 2026 (ending 9/30/2026). That is, if it is not acquired first.

A summary of the business can be found in the most recent (5/2024) investor presentation.

Events that caught my attention:

A little over two months ago, the largest shareholder (Christopher Harborne - 14.9% shareholder) attempted to buy the company at $7.25/share - 17% higher than the current price. This offer was quickly rejected by the board of directors.

The management team has been making what I call, “hidden insider share purchases.” CEO Askarpour desribes it this way:

“ a big portion of our management team's income is tied into RSUs and a significant amount of taxes that you would have to pay out of your own pocket because the management team has not been selling RSUs, unlike some other companies to pay the taxes for it. So that kind of ties up all that -- at least on my part, it ties up all my available cash is to pay 40% taxes on the RSUs. But I think our stock right now is a very, very attractive price.”

The few times I have seen this (management paying their own taxes on stock compensation) the company ended up being acquired in short order.

Newly hired (3/18/2024) CFO Jeffrey DiGiovanni entered a change of control agreement with the company less than three months after he was hired. This is unusual - it is hard to think this move is unrelated to the known acquisition proposal or perhaps other offers that have surfaced.

In my view, the fact pattern suggests that a second acquisition attempt is likely within the next year or two, if not sooner.

This article is a first look at the investment case. I will provide an update after fiscal Q3 results are released.

Innovative Solutions & Support (ISSC):

…a leading systems integrator that designs and manufactures cost effective NextGen flight navigation systems and precision flight instrumentation equipment for the aerospace industry. The world’s most respected aircraft builders, owners and operators rely on our leading edge avionics technology, superior craftsmanship, and stringent quality standards to significantly enhance reliability, performance and provide superior value.

IS&S is a diversified international supplier to Commercial Transport, Military and Business aviation markets. IS&S products include: Integrated NextGen Avionics Suites, Flight Management Systems, Flat Panel Primary and Flight Navigational Displays, Autothrottles, Engine Instrument Displays, Mission Displays, Integrated Standby Units, advanced Global Positioning Systems (GPS), RNP Navigator and Precision Air Data Instruments.

The Company’s objective is to become a leading supplier and integrator of cockpit information, and we believe that our industry experience and reputation, technology and products and business strategy provide the basis to achieve this objective.

Share price: $6.18

Shares outstanding: 17.5 million

Market Cap: $106 million

Enterprise value: 116.4 million

Average dollar trading volume: $241,000

ISSC’s stock has been hit for non-fundamental reasons

Share overhang from sales by founder/CEO’s estate (formerly 20% shareholder - he died in January 2022)

Investors misinterpreted fiscal year-to-date results (i.e. business reality isn’t as smooth as spreadsheet growth models)

Micro-cap blues - too small for popular index inclusion, ISSC has drifted while small caps (as reflected by the Russell 2000) have rocketed higher - further harming sentiment and triggering stop-loss type selling

Profitability/business model inflection point

ISSC is a high quality design and manufacturing aerospace business that has undergone a growth and profitability inflection, yet you would never know it by looking at the stock price.

Key attributes of ISSC’s business

Vertically integrated

Perform all aspects of product design, development, and qualification in the highly regulated (high barriers to entry) aerospace industry

History of winning business against larger competitors (one product attained 60% market share and generated over $100 million in cash flow going head-to-head against two larger competitors)

Highly respected by customers/suppliers/larger competitors

Manufactures all products including all sub-assemblies in house

Produces all electronic circuit cards

Machines own mechanical parts, paints in house

Direct cost of labor is less than 5% of revenue due to extensive automation

Invents on average 7 new patents per year (3 pending, 32 US, 85 international)

High gross margins (+55%)

Existing products are perfectly positioned to capitalize on the future of autonomous flight (first single pilot, then no pilot)

Business is less cyclical than the past

Historically, ISSC focused on the “boom and bust” aftermarket retrofit business. The company would win a large contract and have multiple boom years, followed by a bust when the contract(s) ended.

This extreme cyclicality is reflected in the long-term chart and still scares investors away from the stock.

CEO Shahram Askarpour addressed this concern in a recent investor presentation when he was asked, “…your revenues have historically been very cyclical, how do we know you are not at a peak?”

CEO Askarpour:

“About 12 years ago, I became the President of ISNS and we put a strategy in place to compensate for the cycliality of being in the aftermarket retrofit business. It was to increase the content in the OEM side to take a lot of that guesswork out of the business. The aftermarket business has always been very cyclical because you win one big program, you perform on it, and then it goes down until you win another big program. The OEM business is a lot more predictable year after year you know how much many you are going to ship, you know how much revenue you are going to get. So prior to this acquisition, about 60% of our revenue was predictable because of all the OEM programs we brought in over the last 10 years. Also, the customer service side of the business is also very predictable in terms of how much business you get in a year. With the acquisition from Honeywell, I think that 60% predictability is more towards 75% now because there is a lot of innovative OEM because we sell parts and spares to channel partners and operators, as well as the rest of the customer service, so the predictable portion of our business has improved significantly.

This is what we look at when we look at an acquisition. Does it improve the predictability of our revenue. Does it fall within our portfolio of products, within our customer base which gives us better visibility and lowers the risk?

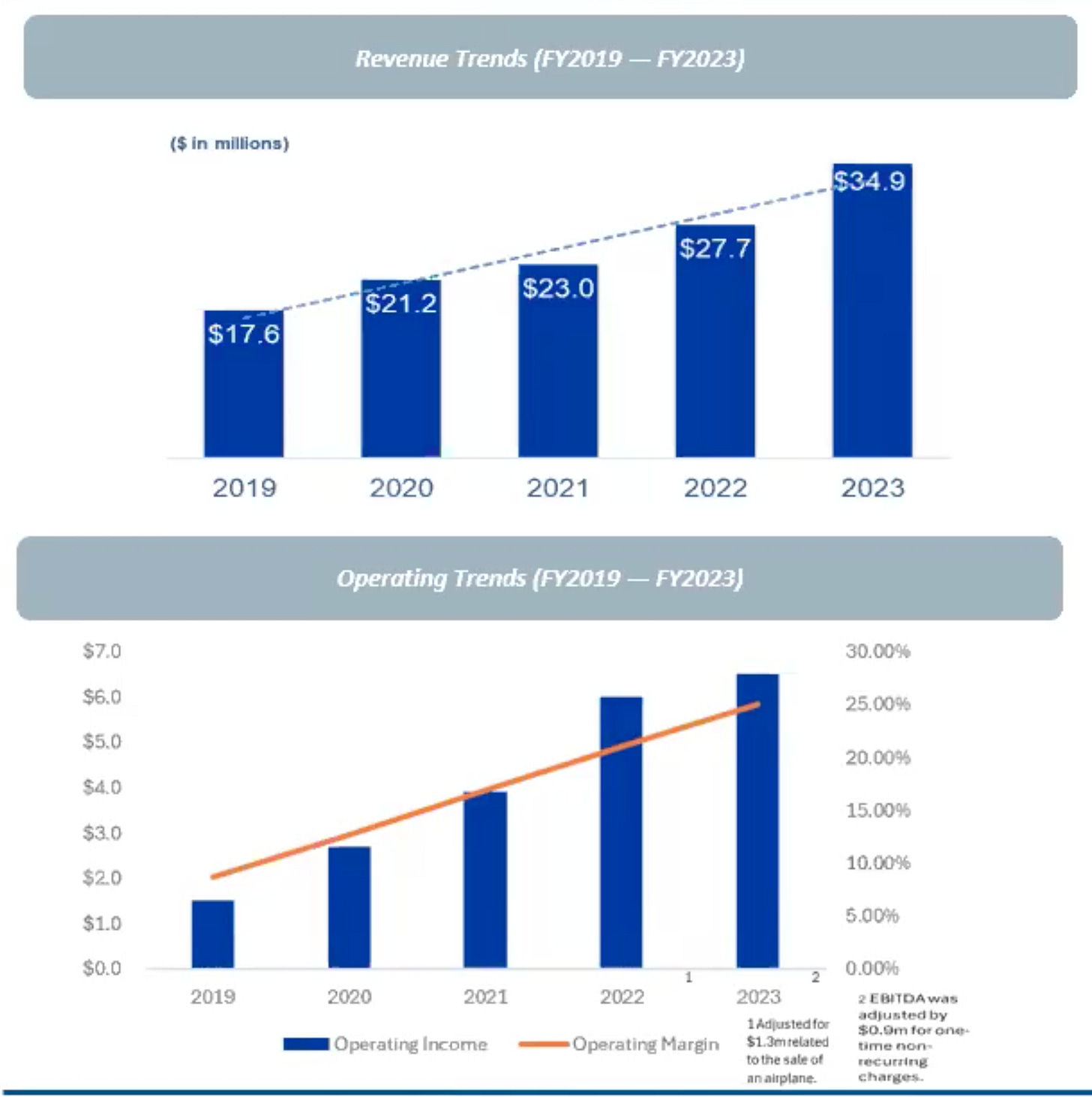

Improved predictability from Askarpour’s strategy is reflected in trailing sales and operating income growth:

The acquisition referred to in the above quote was the acquisition of a product line from Honeywell in 2023. This product line was an excellent fit with ISSC’s existing products, capabilities and customer base.

Q3 2023 earnings call:

“Once fully integrated in 2024, we expect these new products to drive consolidated revenue growth to approximately 40% with an even more significant impact on earnings, where we expect EBITDA to increase by 75% with accretive EPS in 2024.”

Acquisition is more than just “bolt on” revenue and cash flow

Management believes that selling to Honeywell’s customer base will expose new end-users to ISSC’s other suite of products.

ISSC will integrate the Honeywell products into its existing product suite, capturing previously unavailable sales.

Q4 2023 earnings call:

The acquired Honeywell products have put us in front of a new set of buyers, which we believe our sales team can use that relationship to introduce them to our broader range of products. Secondly, we plan to leverage acquired technologies to enhance and expand our product offerings. As an example, with the Honeywell product lines, we now have our own radios and adjacent technology capabilities. We previously had to buy on the open market to integrate into our products.

Slack capacity + high margin product growth = potential for rapid profit growth

Management estimates that post integration of the first Honeywell acquisition, their facility will still only be 50% utilized. There is potential to at least double revenue with very high incremental margins, as new products will require little in the way of capital expenditures

Discussion of incremental margin (Q3 2023 earnings call):

Question:

Have you come up with maybe a rough estimate of how high your incremental gross margins could be when you reach larger sales inflection point, whether it's through organic or inorganic, when you get to something like a $40 million annual sales rate. Could the incremental gross margins be above 70%, 75%?

Answer:

…as sales increase, the margin will increase right along with it, and we were just modeling this just last week. $50 million in sales is going to get us over 30% EBITDA (margin). That will continue to grow, and that EBITDA number is only around 20% projected for this year on roughly $20 million less in sales. So we do see that increasing quite a bit as sales grow.

Management is targeting 10-15% organic revenue growth with an additional growth (summing to +40%) coming from acquisitions. My view is that this is likely a “stretch” target - this exceptional level of growth is not needed for the stock to work from this level.

Less cyclical - but not smooth

While ISSC’s business is becoming less cyclical, no investor should expect results to be smooth on a quarter-to-quarter basis.

This is still a small company - regular lumpiness in sales wins as well as the delay or pull-forward of orders quarter-to-quarter can have a substantial impact on results.

In my view, this is in part what has impacted ISSC’s share price over the past 3-6 months. After a huge 79% sales jump in fiscal Q4 (to $13 million) in the first full quarter after the Honeywell acquisition, sales pulled back (relatively speaking) to $9.1 million and $10.74 million in fiscal Q1 and Fiscal Q2.

Though still up +40% year-over-year, the backsliding from Q4 2023 was likely concerning to investors who don’t listen to earnings calls and expected Q4 to be a new baseline.

Q1-Q2’s (relative) weakness was anticipated in the Q4 earnings call

CEO Askarpour:

Having anticipated some of the disruptions arising from the integration over the first and second quarters of FY 2024, and by customer requests, we accelerated some of the deliveries into the September 2023 quarter. Consequently, we expect results in the current quarter and the next to be weaker than the results of the Q4 2023.

Financial models vs. the reality of business

As investors, we get exited when we see the potential for high margin sales growth with a relatively fixed cost base - this is a recipe for explosive profit growth.

We are then surprised when a company’s results don’t match our spreadsheet forecasts. Unfortunately, running a business is rarely as easy as entering assumptions (guesses) into a spreadsheet.

A few issues impacted ISSC’s Q1/Q2 margins and their interpretation

The cost of transferring manufacture of products to a new facility created inefficiencies/temporary costs

GAAP accounting - a step up in the value of the purchased inventory (from the acquisition) will amortize with sales, increasing cost of goods sold for a period of time (as a side note - it is amusing that private equity firms fight tooth-and-nail to maximize this type of tax-saving expense, while public companies are (often) punished for it)

Margin-boosting cost savings are not instantaneous - in this case, Honeywell was purchasing subassemblies from outside vendors. ISSC plans to manufacture them in-house - they anticipate significant savings once the transition is complete (likely by the end of fiscal 2024).

Management is not experienced with providing guidance. I believe they provided “post integration” figures, which analysts/investors misinterpreted as fiscal year figures. This had the effect of disappointing investors even though results were likely in line with management’s assumptions.

Second Honeywell acquisition announced

On 7/25/24, ISSC announced a second product acquisition from Honeywell.

CEO Askarpour:

“We are pleased by the opportunity to license these additional product lines from Honeywell, which is consistent with our growth strategy, and builds on the successful transaction completed last year,” stated Shahram Askarpour, Chief Executive Officer of IS&S. “These new products will further strengthen our offerings in the air transport, business aviation, and military markets, establish relationships with new key customers and enable us to further leverage the operational capacity in our state-of-the-art Exton manufacturing facility. The product lines previously licensed from Honeywell have provided us the opportunity to generate new incremental revenue streams, drive operating efficiencies, and partner with new customers to pursue new business development opportunities, and we see similar potential benefits from these new assets.”

There is potential that this second acquisition will be smoother and more efficient

Q4 2023 call:

Roger Goldman (private investor)

First of all, congratulations, really well done. This seems like it's going exactly according to the way you told us it would go. And in that connection, any surprises so far with the integration, either good news or bad news?

CEO Askarpour:

Surprises, from my end, it's navigating a large company and the level of [bureaucracy]. I knew it was going to be a challenge, but it's internal communications within Honeywell. You're talking to a group of people that you signed an agreement with and we all understand what it is. But then at the end of the day, you're getting information from some guys down there and they have their own opinion. A lot of levels, a lot of layers…

But I think we've learned a lot of lessons this time around and that there are better ways of making this happen smoothly. Having said that, we're told by folks at Honeywell that this has been by far the smoothest transition that they've done with any of these [indiscernible].

Roger Goldman

Well, a lot of people and companies have made a lot of money doing just what you're doing, which is unencumbering a division from all the corporate, I don't want to say nonsense, but all the corporate structure inherent in being a small division of a big company. And sometimes, there are financial surprises, sometimes good, sometimes bad, that don't rise to the level of -- we've got to redo the contract or we've got to walk away. But nonetheless, they're kind of shocking. And what I'm hearing you say is it's more difficult managerially, but financially, it's right on target.

I highlighted Goldman’s comment because I think it has strong insight into the promise of ISSC’s acquisition strategy.

Focus on the larger picture

Largest shareholder Christoper Harborne’s 5/26/24 letter to the board of directors (where he offered to buy the company for $7.25/share) did a nice job of describing the investment opportunity:

As you know, I am the Company’s largest shareholder, beneficially owning approximately 14.9% of the outstanding shares of the Company’s common stock. As a long-time investor in the aviation and aerospace industries, I made my investment because I believe the Company has the potential in the long-term to be a best-in-class innovative player in those industries; however, based on my observations since I began investing in the Company, I now firmly believe that the Company is not well positioned to achieve this long-term potential in its current configuration and would be best positioned to do so as a privately-held company.

The premium transaction that I am proposing would allow all of the Company’s shareholders to receive today attractive cash value for this long-term potential without continuing to be subject to the significant operational and financial risks inherent in the Company’s business and the risks inherent in remaining as a shareholder in a small public company with limited access to the capital markets and shares with limited trading liquidity and significant market overhang from shares subject to sale by existing shareholders.

My difference with Harborne is that I think ISSC has the ability to capitalize on this potential (the highlighted segment) as a public company.

Harborne is clearly being opportunistic given the non-fundamental decline in ISSC’s share price and the public knowledge that there is a “market overhang” (from the prior CEO’s estate) in the stock.

Regardless, I see Harborne’s $7.25 offer as a nice reference point. I view purchases up to and moderately above this level (~$8/share) as having a margin of safety.

I plan to provide an update article after fiscal Q3 results are released.

I/we own ISSC

Recent (5/2024) investor presentation

Disclaimer

All ideas, reports, articles, and all other features of this subscription product and website are provided for informational and educational purposes. All content and opinions are the subjective opinion of the author. Nothing contained herein is investment advice or should be construed as investment advice. All decisions that you make after reading our articles and reports are 100% your responsibility.

Our analysis is based on SEC filings, current events, interviews, corporate press releases, and other sources of public information. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. There is no guarantee, or suggestion of a guarantee, that our ideas will perform as they have in the past.

This newsletter does not provide buy/sell signals or recommendations of any kind, and articles should not be interpreted as such.

Positive feedback received by subscribers is not verified for accuracy. Any positive returns these subscribers might have achieved was 100% their responsibility and based on their own unique decision process - this newsletter shares ideas but does not provide investment advice or guidance of any kind.

I/my clients or affiliates may hold positions in securities that I write about, which will be disclosed at the time of publication. To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions. If you choose to purchase any security mentioned in any article, report, or post created by this service, that decision, all subsequent decisions as well as the outcome are 100% your responsibility.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss arising, directly or indirectly, from any use of the information contained herein. Nothing presented on this herein constitutes an offer or solicitation to buy or sell any security.