It has been a very quiet month here in terms of portfolio moves, trading, or much of anything else.

However, I wanted to highlight a few things I am looking at, as well as provide a preview on a feature idea I am working on for January.

Sentiment shift on GTX?

My friend John Huber posted this excerpt from a Bloomberg article that caught my attention:

The article, “The Peak in Gasoline Demand Turns Out to Be a Mirage” is effectively a distillation of a few points made in December’s feature article on Garrett Motion.

Indeed, the author could have added a final paragraph opening with, “These are all reasons to be bullish on GTX” and it would have fit right in.

Here is a more extended excerpt:

“The trend of higher-for-longer demand has three important lessons for understanding the energy transition.

First, the stylised forecasts showing sustained demand declines rarely survive the passage of time – not just years later, but often as soon as a few months after publication.

Second, announcements of peak demand generate lots of headlines, but when consumption surges past those peaks, the public rarely hears about it, providing a misleading picture of the pace of the transition.

Third, the shift away from fossil fuels will take longer than many had expected.”

In my view, this article reflects the type of perception shift that will benefit GTX’s trading multiple. The cherry on top is that the company will generate enormous free cash flow while simultaneously funding their new non-ICE product lines.

As the stock screens “clean” of prior capital structure issues, it should continue to gain awareness with its natural shareholder base.

So while the stock has been strong out of the gate, I am looking for much larger upside potential over the next 12-24 months. It would not surprise me to see GTX hit all-time highs (+$20/share) over this time horizon.

Left behind

With the very strong rally that started 11/1, it is always interesting to notice what stocks have been left behind.

One that caught my attention is micro-cap Electromed (ELMD), a stock that I first wrote about here.

Since the above article, the the business has performed well while the hard catalyst I thought might exist (a sale of the business) has not come to pass.

The setup today is extremely similar

We have a small medical device company with a high gross margin product that is under-scale relative its huge potential market, making it costly for the company to grow sales. In other words, it still appears to be a prime takeover candidate.

I started thinking about ELMD again when I noticed that ELMD activist and board member Andrew Summers slightly added to his position in late December.

With two activists among the company’s largest shareholders (the largest shareholder being aggressive activist Bradley Radoff), tons of insider ownership and an extremely sleepy stock price, I still think there is substantial upside potential.

This upside could be realized by either a sale of the company or via increased profitability under the new CEO.

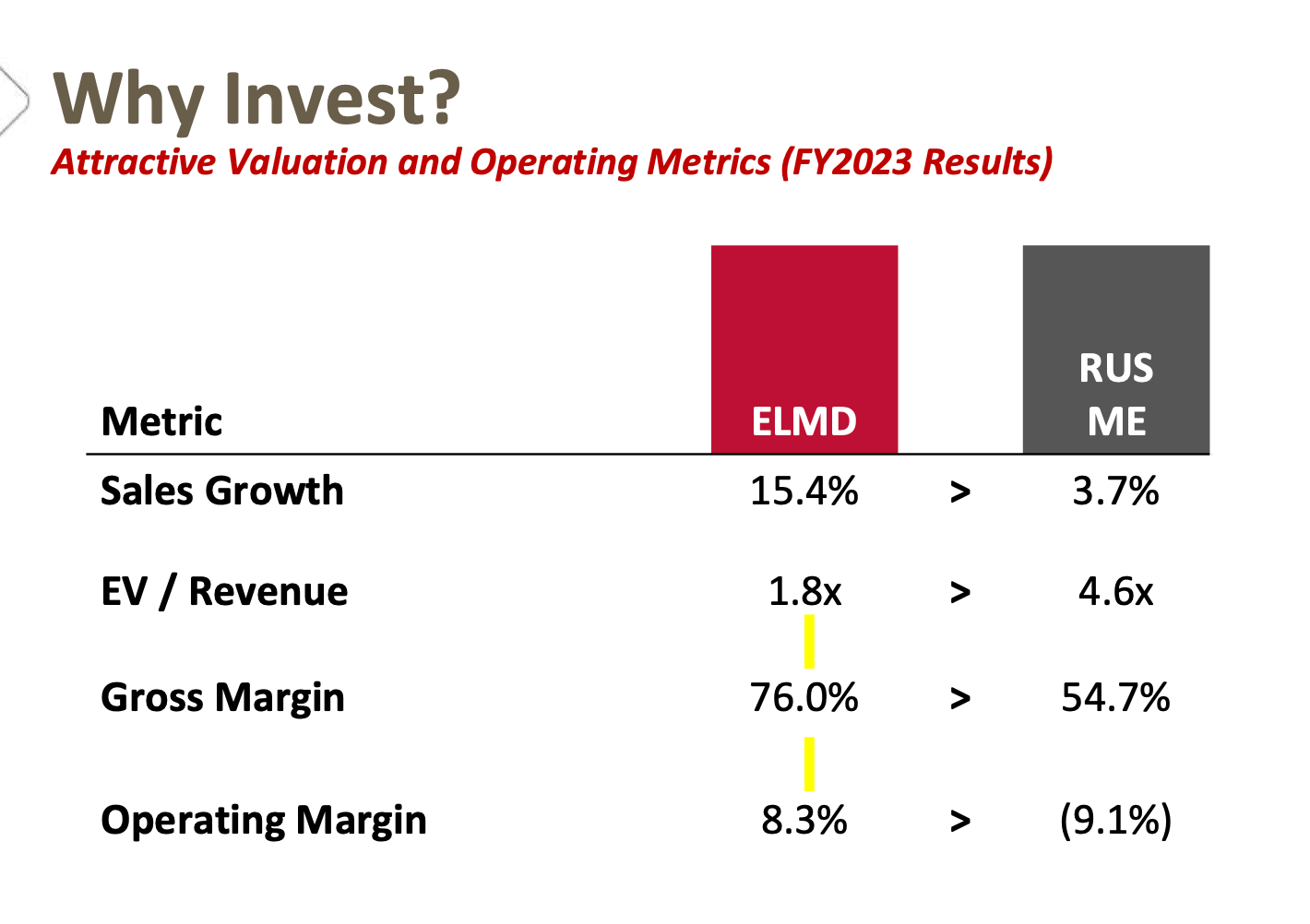

I noticed these two slides in ELMD’s latest presentation:

While simple, the points (executive incentives, the stock’s chronic undervaluation vs. a medical device peer group) are critical.

My belief is that while ELMD has not worked over the past year, the setup is still powerful. The fact is, sometimes little stocks like this get left behind for no good reason.

For those who consider micro caps like this, please keep in mind that ELMD is a true micro-cap ($90 million market capitalization) with generally poor trading liquidity. This is not a time sensitive idea. Anyone who considers ELMD should be aware of potential market impact.

Preview

I am currently working on the first feature article for 2024.

While not set in stone, so far it looks compelling. The idea combines a profitable base business with a surprising “call option” that could dwarf the company’s current market capitalization.

And this is not distant, esoteric upside - it should start positively impacting EPS in 2024. The real upside will come via (potential) licensing agreements or a full sale. The board of directors is high caliber and collectively owns +50% of shares outstanding.

Stay tuned...

I own GTX, ELMD

Disclaimer

All ideas, reports, articles, and all other features of this subscription product are provided for informational and educational purposes. Nothing contained herein is investment advice or should be construed as investment advice. All decisions that you make after reading our articles and reports are 100% your responsibility.

Future ideas are unlikely to perform as well as past ideas. Track records of any kind have limited utility. This newsletter does not provide buy/sell signals and articles should not be interpreted this way.

Our analysis is based on SEC filings, current events, interviews, corporate press releases, and other sources of public information. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. There is no guarantee, or suggestion of a guarantee, that our ideas will perform as they have in the past.

I/my clients or affiliates may hold positions in securities that I write about, which will be disclosed at the time of publication. To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss arising, directly or indirectly, from any use of the information contained herein. Nothing presented on this herein constitutes an offer or solicitation to buy or sell any security.