The most hated spinoff ever?

Some see a dumpster fire - I see hidden value, margin of safety, a clear catalyst, and +100% upside

This security is the most hated stock I have ever seen.

With little over a week of trading history, it has inspired hundreds of unfavorable comments from retail investors as well as mass ETF/Fund selling - it declined ~75% from the when-issued price almost instantly.

Yet a look under the hood suggests that while the assets are out of favor, they are not that bad.

Free cash flow to equity is off the charts.

Multiple approaches to estimating net asset value suggest a value far higher than the current share price.

The company plans to liquidate assets and return capital to shareholders - so this shouldn’t be a case of perpetually trapped value.

Net Lease Office Properties (NLOP)

Share price: $12.63

Share count: 14.27 million

Market cap: $180 million

Net debt: $568 million

Enterprise value: $748 million

NLOP - every behavioral element that can cause a spinoff security can be mispriced is dialed to an extreme setting.

Let’s list a few

Hated/distressed sector (office real estate)

A micro-cap spun off from a much larger security ($180 million vs. $16 billion market cap, or 1.5% of the parent value)

Parent company W.P. Carey (WPC) is widely owned by ETFs/funds that are forced sellers right out of the gate

Investors received ~6.66 shares of NLOP for every 100 of WPC - creating a trivial “stub” position for the original shareholder base

NLOP is REIT security, yet will not have a regular dividend - WPC’s massive dividend seeking shareholder base bails without hesitation

The spinoff it taxable (encouraging a sale to pay the tax)

Extremely poor communication from management regarding NLOP’s value - but for a handful of special situation investors, everyone is trading blind

Similar spinoffs have performed poorly (Realty Income’s spinoff of Orion Office)

Enraged/disgusted investor sentiment - associated with a dividend cut at a former “dividend aristocrat” WPC, an event that triggered mass investor outrage

Setup

On October 6, 2023 (just a few weeks after its last dividend increase) W.P. Carey (WPC) outlined a plan to exit office real estate. This plan consisted of three components.

Spin off majority of office properties into a new REIT, Net Lease Office Properties (NLOP) - NLOP’s business plan is to sell assets over time and return the proceeds to investors

Sell WPC’s retained office portfolio over coming months

Cut the dividend at the parent security, WPC

To get an idea of how extreme the selling pressure has been - the initial “when issued” indicated trading price was $50/share. The stock almost immediately collapsed ~75% when regular way trading started.

In summary - the behavioral bias or “setup” against this security is among the largest I have ever seen, perhaps only tied with the RMR spinoff in late 2015.

Yet, a closer look indicates that this setup has left NLOP a severely undervalued security with substantial upside potential.

Net Lease Office Properties (NLOP) review

Net Lease Office Properties (NYSE: NLOP) is a publicly traded real estate investment trust with a portfolio of 59 high-quality office properties, totaling approximately 8.7 million leasable square feet primarily leased to corporate tenants on a single-tenant net lease basis.

The vast majority of the office properties owned by NLOP are located in the U.S., with the balance in Europe. The portfolio consists of 62 corporate tenants operating in a variety of industries, generating annualized based rent (ABR) of approximately $145 million.

NLOP’s business plan is to focus on realizing value for its shareholders primarily through strategic asset management and disposition of its property portfolio over time.

Portfolio Overview

A full list of properties can be found on pages 18 and 19 in this presentation. This data table was used to compile most of the data mentioned below.

Lease expirations

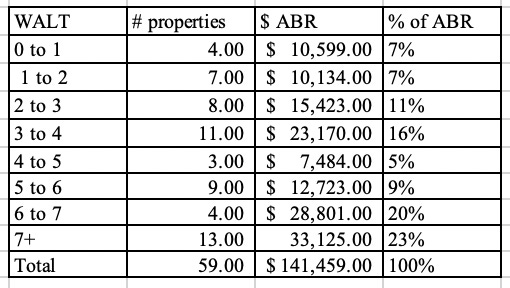

The presentation states that the weighted average lease term (WALT) is 5.7 years. I thought it would be useful to look at this by year:

This looks manageable - close to 60% of annual base rent (ABR) has a WALT of over four years, and just 14% is less than two years.

Financing

In addition to the Mortgage loan and mezzanine loan mentioned above, 14 other properties have mortgages with a cumulative balance of $169 million. The remaining five properties are unencumbered.

Management comment on NLOP financing:

“The NLOP Financing Arrangements are structured to provide it with the ability to engage in dispositions of assets as contemplated by its overall strategy and intends to pay down the NLOP Financing Arrangements with proceeds from such dispositions and cash flow from rent on its properties. As of the date that the NLOP Financing Arrangements were entered into, based on the appraisals provided to the Lenders, NLOP had a loan-to-value ratio of approximately 43% with respect to the Mortgaged Properties, implying a value of approximately $163 per square foot for the Mortgaged Properties.”

Valuation

There are a number of ways to look at this question, so we will view this from a few different angles. There is substantial overlap, but I think different approaches aid in grasping the situation.

Implied value of 40 property portfolio

The $455 million in financing was secured by a 40-property portfolio. These loans were recently underwritten by J.P. Morgan (JPM) at a 43% loan to value ratio, as stated in the above quote. This suggests a total portfolio value of $1.06 billion (455 / .43).

If we subtract the $455 million of debt from this $1.06 billion figure, we get an equity value of $604 million. In other words, based on JPM’s recent underwriting, this 40 property portfolio alone is worth $42/share.

An additional exercise (that will be useful in a minute) is to compute the implied cap rate on this $1.06 billion enterprise value. This lets us know how JPM valued the portfolio.

Annual Base Rent (ABR) on these properties is $101.7 million. After deducting a prorated portion (72%) of direct property expenses, I get an NOI figure of $96.6 million per year. Using the enterprise value figure of $1.06 billion, the implied cap rate is 9.1%.

Value per square foot

If we use the $163 per square foot value from JPM and apply it to the entire portfolio, we get an enterprise value of $1.42 billion. If we subtract net debt of $568 million, we get an equity value of $850 million, or $59/share.

Implied cap rate

Perhaps the simplest way to view value is to compute an implied cap rate given the current enterprise value and net operating income (NOI).

I believe this is reasonable, as the business plan is to liquidate the portfolio and return the surplus value to shareholders.

Market cap: $180 million ($12.63/share * 14,270 shares)

Net debt: $568 million

Enterprise value: $748 million

Net operating Income: $134 million

Implied property-level cap rate: 18%

This is an extraordinarily high cap rate, particularly relative to the 9.1% cap rate implied by JPM’s underwriting. At a 9.1% cap rate, the implied NAV is $63/share. At a highly punitive cap rate of 13.5%, the implied NAV is still $30/share.

Free cash flow multiple

Another way to consider the value is the free cash flow to equity as an ongoing entity.

Here are my estimates (data taken from the Form 10 information statement and the investor presentation linked above).

The trickiest part is interest expense. My number was computed from the stated loans/mortgages outstanding and interest rates. I include the 4% PIK component on the mezzanine loan.

The pro-forma interest expense in the Form 10 is higher than this. My belief is that this is related to how JPM’s underwriting fees are accounted for in the current period (which also impacts the debt balance), but this needs to be clarified.

Using my estimates, FCFE is around $58 million/year. At a $180 million dollar market cap, the multiple is hardly over 3X, and the FCFE yield is north of 32%.

This is extremely cheap by any measure and suggests there will be ample room to pay down debt and absorb a reasonable level of unfavorable leasing outcomes.

Three value buckets

I think the best way to consider NLOP’s value is to group the company’s portfolio into three value buckets

The 40 buildings used as collateral for the $455 million of spinoff related financing

The 14 assets with individual mortgages

The 5 unencumbered assets

40 building bucket

We have already done the work on this. As I stated above:

The 40-property portfolio used as collateral for $455 million in debt was underwritten at a 43% loan to value ratio. This suggests a total portfolio value of $1.06 billion and a 9.1% cap rate.

If we subtract the $455 million of debt from this figure, we get an equity value of $604 million. In other words, based on JPM’s recent underwriting, this portfolio alone is worth $42/share.

14 mortgaged properties

This appears to be the weakest asset pool in terms of residual equity value. My review suggests that a few of the properties might be worth little if anything above the outstanding mortgage balances. It also has the most re-leasing risk, with a WALT of 2.6 years.

After reducing ABR by a prorated portion of direct property expenses (18%), NOI is $23.9 million. At a 10.5% cap rate and subtracting the $169 million in mortgages, we are left with $72 million for equity, or $5/share.

Unencumbered properties

This pool of assets is interesting. Management’s comments (and the presentation) do not seem to directly refer to the existence of encumbered properties - you have to notice that 40 + 14 doesn’t equal 59 or study the asset list.

The WALT on this portfolio is 6.24 years (similar to the 40 property JPM portfolio), and three of the five assets are located outside of the United States. Annual rent is $14.5 million. After prorated expenses (10%) NOI is around $13.8 million.

At a 10% cap rate, this unencumbered portfolio alone is worth $9.70 a share - or 3/4 of NLOP’s current share price.

Management and Incentives

NLOP will be externally managed by WPC and will pay a $7.5 million/year management fee that will decline over time as assets are sold. While it could appear this fee reduction with sales is a negative incentive, I don’t see it this way. This trickle of fees is irrelevant to WPC. What might move the needle is management-level incentives.

NLOP-based incentive compensation for management has been authorized, but there is not yet a plan in place. My hunch is that management will drag their feet on highlighting NLOP’s value until their NLOP performance compensation plan is in place. This is something I will be watching for.

We can get a feel for a potential plan by looking at the award limits:

3.3 Individual Award Limits. Notwithstanding any provision in the Plan to the contrary, and subject to Section 10.2 hereof, (a) the maximum aggregate number of Common Shares with respect to one or more Awards that may be granted to any one individual during any calendar year shall be 850,000 Common Shares, (b) the maximum aggregate amount of cash that may be paid in cash during any calendar year with respect to one or more Awards payable in cash shall be $10,000,000, and (c) the sum of any cash compensation and the value (determined as of the date of grant under Applicable Accounting Standards) of Awards granted to any Non-Employee Trustee during any calendar year may not exceed $1,000,000 (together, the “Individual Award Limits”).

As the liquidation will be a multi-year process, there is potential for management to make substantial sums executing on NLOP’s strategy. This is something I would like to see - I want management to have strong incentives to act in our interests.

Conclusion

Mass individual and institutional selling has created a first week trading price for NLOP that is wildly at odds with even a pessimistic view of NLOP’s underlying assets.

When I analyzed the stock prior to the spinoff, I guessed it would start trading at around $25/share. I saw this as a good potential value with upside, but not a screaming buy relative to the risks.

Trading at just 1/2 of my guesstimated initial trading range makes the stock enormously more compelling.

If we sum up the equity value in the three “asset buckets” and add the expected cash balance, we get an equity value of $57.68 per share.

This value doesn’t include transaction costs related to selling properties, but it also doesn’t include the benefit of paying down debt with FCF during the liquidation period.

The above is not remotely close to a precise valuation. Given the small equity value relative to enterprise value, small tweaks to assumptions can radically alter the potential value.

However, even highly punitive cap rates (including allocating zero value to the 14 mortgaged properties) still create +100% upside potential.

If the liquidation process takes 3-5 years, there is enough NAV (and free cash flow along the way) to generate a highly favorable IRR from today’s share price.

The most bullish outcome will occur if “green shoots” appear in office and interest rates (SOFR) decline over the next few years. In a bearish situation, at the current valuation I think there is a high probability that we will still get our investment back.

Shorter term, I wouldn’t be surprised if simple awareness and exhaustion of the initial sentiment/forced selling wave is enough to move the stock north of $20/share.

I/We own NLOP

Disclaimer

All ideas, reports, articles, and all other features of this subscription product are provided for informational and educational purposes. Nothing contained herein is investment advice or should be construed as investment advice. All decisions that you make after reading our articles and reports are 100% your responsibility.

The service is intended as a source of potential ideas to incorporate into your own process. This newsletter does not provide buy/sell signals and articles should not be interpreted this way.

Our analysis is based on SEC filings, current events, interviews, corporate press releases, and other sources of public information. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. There is no guarantee, or suggestion of a guarantee, that our ideas will perform as they have in the past.

I/my clients or affiliates may hold positions in securities that I write about, which will be disclosed at the time of publication. To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss arising, directly or indirectly, from any use of the information contained herein. Nothing presented on this herein constitutes an offer or solicitation to buy or sell any security.

Lol I guess there is now a Nat Stewart effect, congrats!

Stock is getting donkey kicked today. Not much volume though. Any thoughts?